All about Feie Calculator

Table of ContentsFeie Calculator Can Be Fun For AnyoneNot known Details About Feie Calculator Feie Calculator - An OverviewThe 9-Minute Rule for Feie CalculatorSome Known Details About Feie Calculator See This Report about Feie CalculatorGetting The Feie Calculator To Work

If he 'd often taken a trip, he would certainly instead complete Component III, providing the 12-month period he satisfied the Physical Visibility Test and his traveling history - Form 2555. Step 3: Reporting Foreign Revenue (Component IV): Mark gained 4,500 each month (54,000 each year). He enters this under "Foreign Earned Earnings." If his employer-provided real estate, its value is likewise consisted of.Mark computes the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his income (54,000 1.10 = $59,400). Given that he stayed in Germany all year, the percent of time he lived abroad during the tax is 100% and he gets in $59,400 as his FEIE. Mark reports overall salaries on his Type 1040 and goes into the FEIE as an adverse amount on Schedule 1, Line 8d, decreasing his taxable earnings.

Picking the FEIE when it's not the very best option: The FEIE might not be suitable if you have a high unearned income, earn greater than the exemption restriction, or live in a high-tax nation where the Foreign Tax Debt (FTC) might be more helpful. The Foreign Tax Credit (FTC) is a tax decrease method typically utilized together with the FEIE.

4 Easy Facts About Feie Calculator Explained

expats to offset their united state tax obligation financial debt with foreign revenue tax obligations paid on a dollar-for-dollar reduction basis. This implies that in high-tax countries, the FTC can frequently eliminate united state tax financial obligation totally. The FTC has constraints on eligible tax obligations and the optimum case amount: Qualified taxes: Only earnings tax obligations (or taxes in lieu of earnings taxes) paid to foreign governments are eligible (Foreign Earned Income Exclusion).

tax responsibility on your international earnings. If the international tax obligations you paid surpass this restriction, the excess foreign tax obligation can usually be continued for as much as ten years or returned one year (by means of a modified return). Keeping exact records of international revenue and taxes paid is as a result crucial to determining the appropriate FTC and keeping tax conformity.

migrants to decrease their tax liabilities. As an example, if a united state taxpayer has $250,000 in foreign-earned earnings, they can leave out as much as $130,000 using the FEIE (2025 ). The staying $120,000 might after that go through tax, however the united state taxpayer can possibly apply the Foreign Tax Credit report to balance out the tax obligations paid to the foreign country.

The 5-Minute Rule for Feie Calculator

He marketed his United state home to develop his intent to live abroad completely and applied for a Mexican residency visa with his spouse to aid accomplish the Bona Fide Residency Examination. Neil directs out that acquiring home abroad can be testing without very first experiencing the area.

"We'll definitely be beyond that. Even if we return to the United States for medical professional's appointments or business calls, I doubt we'll spend even more than 1 month in the US in any kind of given 12-month duration." Neil highlights the relevance of rigorous tracking of U.S. visits. "It's something that individuals require to be truly diligent concerning," he claims, and encourages deportees to be mindful of usual errors, such as overstaying in the united state

Neil takes care to stress to U.S. tax obligation authorities that "I'm not performing any company in Illinois. It's just a mailing address." Lewis Chessis is a tax expert on the Harness system with comprehensive experience aiding united state citizens browse the often-confusing realm of worldwide tax obligation conformity. Among one of the most common false impressions amongst united state

Feie Calculator - Truths

tax return. "The Foreign Tax Credit allows people working in high-tax nations like the UK to offset their U.S. tax obligation obligation by the quantity they have actually currently paid in taxes abroad," states Lewis. This makes certain that deportees are not exhausted twice on the same earnings. Nonetheless, those in reduced- or no-tax countries, such as the UAE or Singapore, face extra difficulties.

The possibility of reduced living costs can be appealing, but it usually features trade-offs that aren't right away evident - https://trello.com/w/feiecalcu. Real estate, for instance, can be extra cost effective in some countries, yet this can imply compromising on infrastructure, safety, or access to trustworthy energies and solutions. Low-cost residential properties could be found in locations with inconsistent net, limited mass transit, or undependable healthcare facilitiesfactors that can substantially impact your daily life

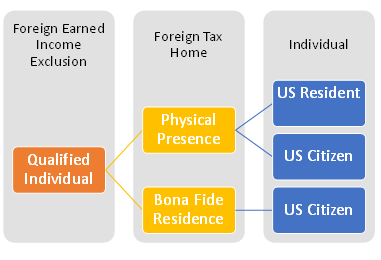

Below are a few of the most often asked questions regarding the FEIE and various other exemptions The International Earned Income Exclusion (FEIE) enables U.S. taxpayers to omit approximately $130,000 of foreign-earned income from government earnings tax, decreasing their U.S. tax obligation. To qualify for FEIE, you must meet either the Physical Visibility Test (330 days abroad) or the Bona Fide House Examination (show your primary house in a foreign nation for an entire tax year).

The Physical Existence Test requires you to be outside the united state for 330 days within a 12-month duration. The Physical Visibility Test likewise needs U.S. taxpayers to have both a foreign revenue and an international tax home. A tax home is specified as look at this website your prime location for company or work, no matter of your family members's house. https://www.twitch.tv/feiecalcu/about.

The Feie Calculator PDFs

An earnings tax treaty in between the united state and one more country can help avoid double tax. While the Foreign Earned Income Exemption lowers taxable revenue, a treaty might offer fringe benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a required declare U.S. people with over $10,000 in international economic accounts.

The international gained income exclusions, occasionally described as the Sec. 911 exclusions, exclude tax obligation on earnings earned from working abroad. The exclusions comprise 2 parts - an earnings exemption and a housing exclusion. The adhering to FAQs go over the benefit of the exclusions including when both spouses are deportees in a basic fashion.

Some Known Factual Statements About Feie Calculator

The tax advantage omits the revenue from tax at lower tax rates. Previously, the exclusions "came off the top" minimizing income topic to tax obligation at the top tax rates.

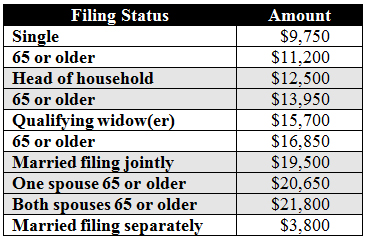

These exemptions do not excuse the wages from United States taxation yet simply provide a tax reduction. Note that a bachelor working abroad for every one of 2025 who made concerning $145,000 without various other earnings will have taxed income decreased to no - properly the same answer as being "tax obligation complimentary." The exclusions are computed each day.

If you participated in business meetings or workshops in the United States while living abroad, earnings for those days can not be omitted. For US tax obligation it does not matter where you maintain your funds - you are taxable on your around the world earnings as a United States person.

Comments on “The 6-Second Trick For Feie Calculator”